foreign gift tax cpa

Foreign gift is not. Aerospace Company Tax Audit.

Estate Planning Baldwin Accounting Cpa Orlando Florida

To make an appointment.

. Get us on New York New Jersey let us help. Magone Company PC. Our international tax advisory services are aimed at helping you maximize foreign tax credits to lower your tax liabilities so you keep more of your hard earned money.

Our staff is fluent in Hebrew and Spanish. Gift tax would be due on gifts exceeding the 15000 exclusion amount. Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than.

The individual that offered the gift would be responsible for paying the gift tax. Regarding the latter as of 2019 you will need to file Form 3520 if youre a US. Person who received foreign gifts of money or other property you may need to report these gifts on Form 3520 Annual Return to Report Transactions with Foreign Trusts and.

Although reporting is only. Contact us now at 732-777. IRS Tax Audit Guides for Business Owners.

Audits of Real Estate. CPA First has experienced international tax accountants quality tax lawyers who provide all kinds of international accounting tax services. CPA Ted Kleinman has over three decades of experience and knowledge in dealing with IRS tax regulations and he will ensure that your tax needs are addressed.

Foreign gift tax cpa Tuesday May 17 2022 Edit. Klasing online or call 800 681-1295 today. CPA firm providing international tax advisory services to foreign corporations conducting business in the United States as well as American citizens.

TAX AUDITS APPEALS. We are the American Institute of CPAs the worlds largest member association representing the accounting profession. Tax Planning for Foreign Companies.

Penalty for non-compliance. We frequently review and analyze tax returns bank statements contracts and other tax documents in both languages. In general the due date.

File Form 3520 each year you receive a foreign gift separately from your income tax return by following the directions in the Instructions to Form 3520. Citizen and you received 100000 or more from a nonresident alien individual or foreign estate. If the gift was given as an inheritance then the estate of the decedent must pay it.

While you may not have to. Our history of serving the public interest stretches back to 1887. If you are a US.

Specifically the receipt of a foreign gift of over 100000 triggers a requirement to file a Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign. However if the gift is from a foreign corporation or foreign partnership the threshold is much lower 14375 for gifts made during a tax year beginning in 2011. Greater of 10000 or 35 of the gift received additional penalties may also be imposed if failure to file is not corrected.

If the gift is from a nonresident alien or a foreign estate reporting is only required if the total amount of gifts from the nonresident alien or foreign estate is more than 100000 plus an.

Form 3520 What Is It And How To Report Foreign Gift Trust And Inheritance Transactions To Irs Youtube

Firpta Reilly Fisher Solomon Certified Public Accountants

Amazon Foreign Sellers U S Taxation And 1099 K Reporting O G Tax And Accounting

California Gift Taxes Explained Snyder Law

The New Exemption From Required Information Reporting The Cpa Journal

Kaufman Accounting Tax Accountant

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Brenda M Bianculli Cpa Llc Our Services

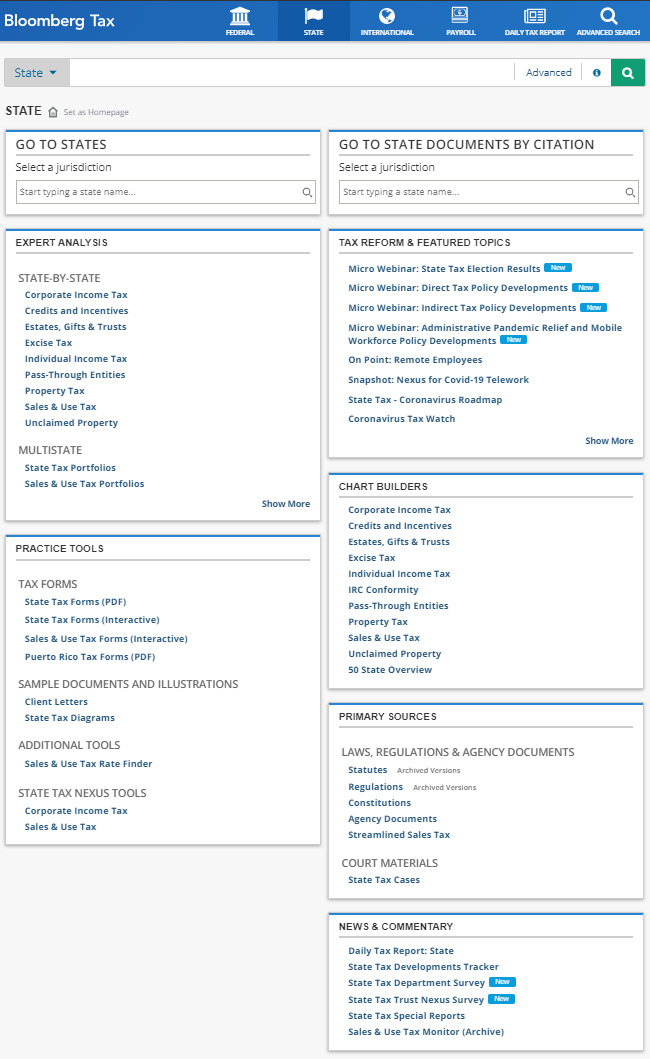

Getting Started Bloomberg Tax Bloomberg Tax

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

The Chinese American Society Of Cpas

U S Estate And Gift Tax Singerlewak

Understanding Us Gift Tax Return Irs Form 709

Fa La La Falling Afoul Of Foreign Gift Rules Ryan Wetmore P C

![]()

2022 International Tax Update Individual And Estate Tax Western Cpe

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Estate And Trust Tax Return Preparation

Crypto Tax Accounting 2022 How To Report Cryptocurrency Taxes